Seattle

Second article in a series on minimum wages.

Note: This is an expanded, footnoted version of the article published by Inter Press Service.

In 1958, when New York State was considering raising its minimum wage 33% from $0.75 to $1.00, merchants at hearings complained that their profit margins were so small that the increase would force them to cut their work forces or go out of business.[1] In Seattle in 2014 at hearings on a proposed 61% minimum wage increase from $9.32 to $15.00, some businesses voiced the same fears.

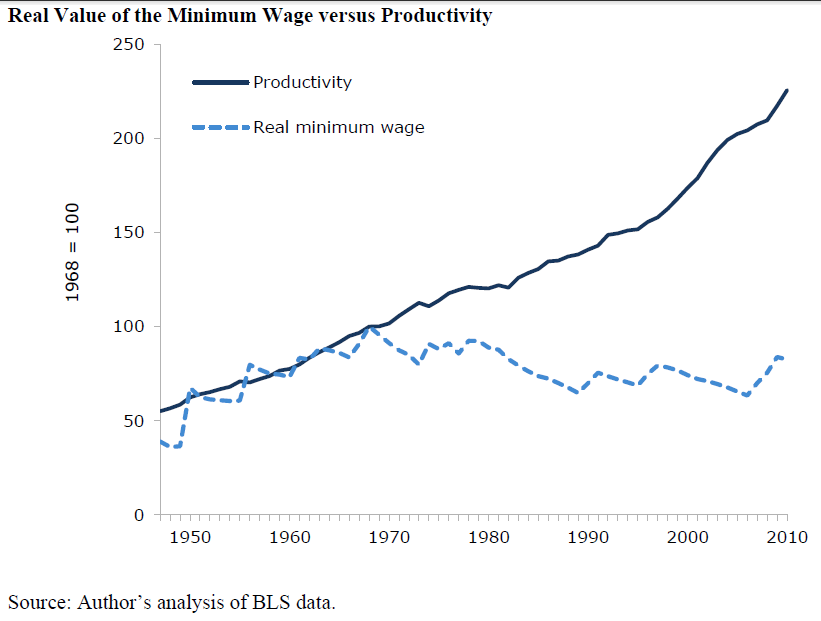

A national minimum wage was established in the United States in 1938 by the Fair Labor Standards Act. Since then, Congress has increased it every few years, although since 1968 it has fallen far behind inflation and productivity growth.

By 2015, over half of the states[2] and many localities will have increased local minimum wages above the federal level. Several major cities, including New York, Chicago, Los Angeles, San Francisco, Oakland (California) and San Diego (California), are currently considering raising their wage floors.[3]

Each time such raises are proposed, bitter debates break out over the potential effects. Somehow, though, economic devastation has been repeatedly averted.

History

Historically, the yearly average for recent local minimum wage increases has been 16.7%.[4] But some increases have been far higher. For example, in 1950 the national minimum wage jumped 87.5% from $0.40 to $0.75. And in 2004, the city of Santa Fe, New Mexico, raised its minimum from $5.15 to $8.50, a 65.0% increase.

Even after Santa Fe’s big raise, the average cost increase for all businesses caused by the raise was around one percent. For restaurants, the increase was a little above three percent.[5] The effects may have been so small in part because Santa Fe may have had an unusually low percentage of workers earning close to the old minimum wage.[6]

Santa Fe’s Mayor, David Coss, summed up the experience: “I am proud of Santa Fe’s living wage law. I am also very proud of the businesses in Santa Fe who pay a living wage. Our work on the living wage has made Santa Fe a national leader and has strengthened our economy, community and working families.”[7]

Accounting

The small impact of raising the wage floor may be surprising to those unfamiliar with the historical record. But the accounting is straightforward. Nationally, only 4.3% of all workers earn the federal minimum wage or lower; perhaps two or three times that number would have their wages lifted by a moderate minimum wage hike. All the rest of the workforce would not be affected by the increase.[8]

Among those covered, the average raise will be somewhere around half of the nominal raise from old to new minimum, because most affected workers will have wages somewhere in between. As a result, the total growth in payroll is small for most businesses. And payroll, in turn, averages only about one-sixth of gross revenues for all industries nationally.[9]

These effects, multiplied together, yield very small total increases in costs on the average and for the great majority of businesses.

Employment

Because total cost increases are minimal for most businesses – even in more-affected industries – and can be covered by other adjustments, the loss of low-wage jobs because of moderate minimum wage raises’ has been close to zero. The broad consensus that has emerged from the evidence is that they have no significant effects on employment.[10]

Over the past two decades, the results on the ground of national, state and local increases have been studied intensively using empirical methods that control for other possible influences.

A comprehensive study of state minimum wage increases in the U.S. found “no detectable employment losses from the kind of minimum wage increases we have seen in the United States”, including for the accommodations and food services sector.[11] Two recent meta-studies that analyzed the past two decades of research seconded these findings.[12] Other rigorous economic examinations of minimum wage increases in cities including Santa Fe, San Francisco and San Jose also found no discernable negative effects on employment for low-wage workers.[13]

A study by economists John Schmitt and David Rosnick of the Center for Economic and Policy Research concluded: “The results for fast food, food services, retail, and low-wage establishments in San Francisco and Santa Fe support the view that a citywide minimum wages can raise the earnings of low-wage workers, without a discernible impact on their employment. Moreover, the lack of an employment response held for three full years after the implementation of the measures, allaying concerns that the shorter time periods examined in some of the earlier research on the minimum wage was not long enough to capture the true disemployment effects.”[14]

As Harvard economist Richard Freeman put it, “The debate is over whether modest minimum wage increases have ‘no’ employment effect, modest positive effects, or small negative effects. It is not about whether or not there are large negative effects.”[15]

A letter to the President and Congress signed by 600 economists, including seven Nobel Prize winners, supported raising the national minimum wage to $10.10: “In recent years there have been important developments in the academic literature on the effect of increases in the minimum wage on employment, with the weight of evidence now showing that increases in the minimum wage have had little or no negative effect on the employment of minimum-wage workers, even during times of weakness in the labor market. Research suggests that a minimum-wage increase could have a small stimulative effect on the economy as low-wage workers spend their additional earnings, raising demand and job growth, and providing some help on the jobs front.”[16]

Even The Economist, the influential British neoliberal magazine, recently observed: “No-one who has studied the effects of Britain’s minimum wage now thinks it has raised unemployment.”[17]

Income

In worst cases, some employers may face larger increases in payroll than they can absorb with price increases and increased efficiencies. But even for them, the response will much more likely be to reduce hours slightly than to cut jobs, because laying off and hiring are expensive and disruptive.[18] In such cases, any increase in wages large enough to prompt a reduction in hours would likely be big enough that the paychecks of workers receiving it would still come out ahead.[19]

In many low-wage jobs, hours already fluctuate from week to week, workers frequently change jobs voluntarily or involuntarily, jobs come and go, and businesses start up and fold. For low-wage workers already facing this instability, higher total yearly pay nearly always trumps any loss of yearly hours. In fact, working fewer hours can be a benefit in this case, as it leaves more time for family, training or other work.[20]

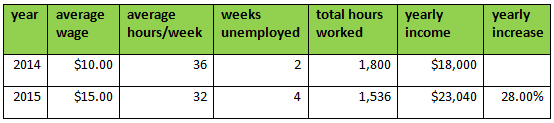

For low-wage workers, employment effects show up primarily in average hours worked weekly and total time out of work yearly. As a hypothetical case, if my hourly wage goes up 50% from $10.00 to $15.00, but my average weekly hours worked drop from 36 to 32 and I’m out of work for 4 weeks instead of 2 weeks, I’m still considerably ahead of the game with a 28.0% increase in my yearly income. If I qualify for unemployment insurance for the weeks out of work, my situation is even better.

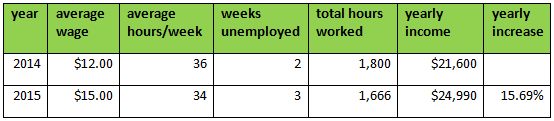

Alternatively, let’s say I’m making $12.00 when my wage rises to $15.00, a 25% increase. Assuming my average weekly hours worked drop from 36 to 34 and I’m out of work for 3 weeks instead of 2 weeks, my yearly income would still be 15.69% higher.

These examples intentionally use improbably large reductions in hours and increases in unemployment, despite strong evidence that cities that have implemented substantial wage increases have seen no significant employment effects.

Ripples

Minimum wage increases do have the effect of compressing the lower part of the pay scale. Those who were making around the old minimum will now be making nearly the same as those who were making near the new minimum. The differences between the lower rungs of the wage ladder will now be much diminished, which may prompt changes in business processes and work relationships.[21]

In this situation, most businesses try to maintain some hierarchy, with the new minimum pushing up the wage levels just above it by small amounts. But this “ripple effect” of small cascading raises adds only a little to total payroll costs.[22] For a 1997 increase of 8% in the federal minimum from $4.75 to $5.15, one study found that workers who had been earning just above the new minimum got a 2% increase (roughly $0.10), and those up to about 10% above the new minimum got a 1% increase (roughly $0.05).[23]

The same study also found that a 2004 increase of 19.4% in the Florida state minimum caused an average cost increase for businesses, from both mandated raises and ripple effects, of less than one-half of 1% of sales revenues. For the hotel and restaurant industry, the average cost increase was less than 1.0%.[24]

The size of ripple raises will depend in part on how important maintaining wage-level distinctions is to employees and employers. It will also be affected by competition from the rest of the low-wage labor market.

Raising the wage floor generally rewards businesses who already pay higher wages towards the bottom of the scale, because minimum wage increases will be a smaller percentage of costs for them. So even contemplating minimum wage legislation could offer incentives to employers to maintain less unequal wage scales.

Exceptions

Only one sector has significantly higher concentrations of low-wage workers and a larger proportion of expenses in payroll: accommodations and food services. It is not a major part of the economy in most places: nationally it accounts for 2.2% of sales, 3.6% of payroll and 10.8% of employment.[25] In these industries, 29.4% of workers are paid within 10% of the minimum wage,[26] and the rule of thumb for restaurant payroll is about one-third of total revenues, twice the overall proportion.

Even for hotels and restaurants, however, larger rises in operating costs are still covered mainly by modest price increases, on the order of 3.2% for a 50% minimum raise by one estimate, and significant reductions in turnover, ranging between 10% and 25% of the costs of raising the wage.[27] Many businesses in this sector have enough flexibility to raise prices without reducing revenues, especially when local competitors all face the same wage increases.[28] They may also be able to raise revenues by increasing sales volume.

In retail, another sector employing some low-wage workers, only 8.8% of the workforce is paid within 10% of the minimum wage.[29] So any minimum wage increase has a much smaller effect on average total costs than in the lodging and food service sector.

Adjustments

In all sectors, lower-wage workers tend to have higher turnover rates, sometimes more than 100 percent annually, yet firing and hiring entail significant costs.[30] Minimum wage increases often help trim these personnel expenses by reducing workforce turnover and absenteeism.[31] The savings, by one estimate, may range from 10% to 25% of the increased payroll costs from raising the minimum.[32]

Businesses may also gain from better-paid and more secure workers becoming more productive. Improvements in business processes and automation can lower expenses and increase quality. And better performance may be required of employees who are now paid higher.[33]

Other possible channels through which businesses can compensate for payroll growth include reductions in benefits or training, changes in employment composition, improvements in efficiency and automation of work processes. Some employers may also accept a small reduction in profits until the wage increases are absorbed.[34]

Even given these multiple channels for adjustment, there are often small businesses and non-profits who find it hard to cover a minimum wage increase – often because they depend heavily on low-wage labor or are unable to raise prices easily. In recognition of this, most local minimum wage increases either exempt smaller firms and non-profits, as in Santa Fe and San Francisco, or phase in increases more slowly for them, as in Seattle.

Stimulus

In the broader economy as well, raising the wage floor may have positive effects. Increased spending prompted by higher wages can stimulate growth in low-wage workers’ neighborhoods.[35]

Rising minimum wages also often reduce government spending on low-income tax credits and poverty programs such as food stamps. Contributions to unemployment insurance, Social Security and Medicare rise with higher incomes. Any positive or negative effects, though, will tend to be small-scale relative to the overall economy.

Given the major positives for low-wage workers and society at large, along with the relatively minor negatives, it is not surprising that nearly all groups with a track record of advocacy for these workers, such as unions, low-income community groups and non-profits serving them, support minimum wage increases.

In an era of secular stagnation and political stalemate, minimum wage increases offer an effective, politically popular, and positively motivating way to reduce income inequality from the bottom up, without reducing low-wage employment.

Example: Crunching the numbers for a small business

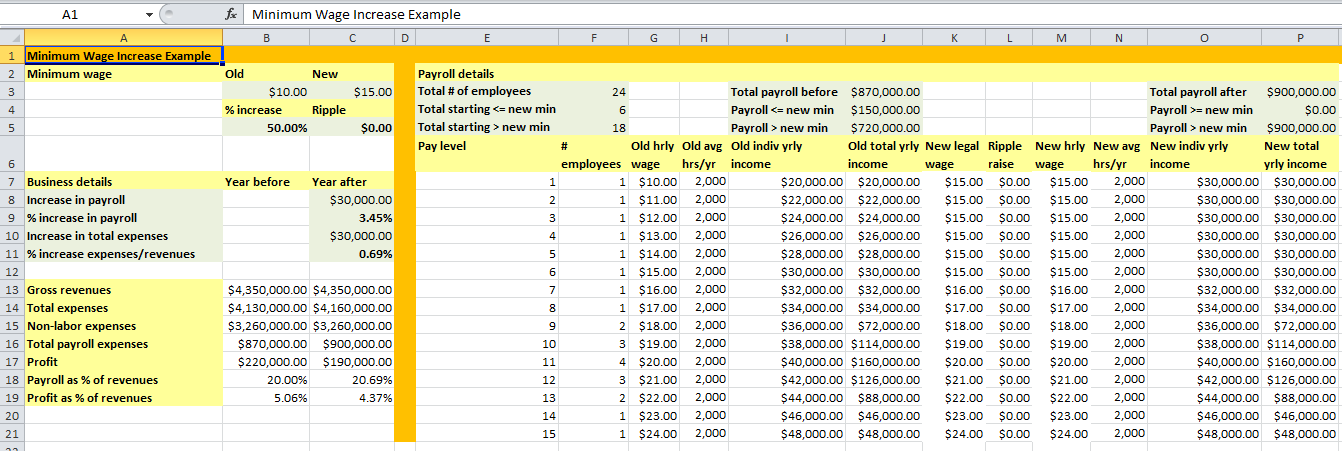

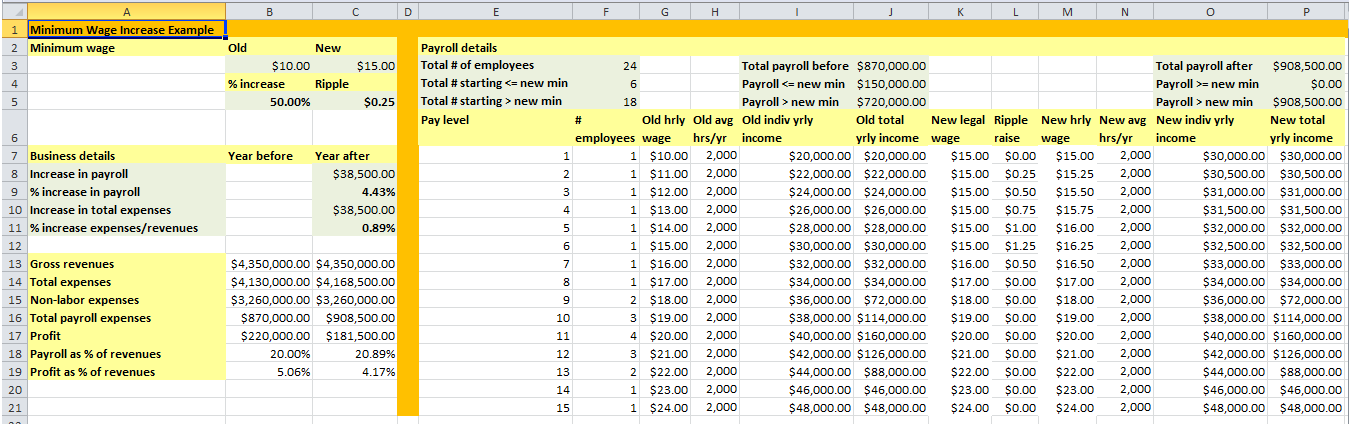

To get a concrete sense of how raising the wage floor plays out, a little arithmetic goes a long way. Let’s take a hypothetical example of a big raise of 50% in one year, from $10.00 to $15.00.

We’ll zoom in from macro to micro and crunch some simplified numbers for a typical small business that employs 24 workers. Six of them make below or equal to the new minimum: one each makes $10.00, $11.00, $12.00, $13.00, $14.00, and $15.00. The other 18 employees make an average wage of $20.00, and all workers work 2,000 hours per year. The total payroll of this company is 20% of its gross revenues and its profits are 5%.

The average pre-increase wage of the five workers getting a raise is $12.00 per hour, $10.00 through $14.00 divided by five, and their average raise is $3.00. This computes to a 25% – not 50% – average raise for the five covered workers. For the total payroll, this represents an increase of 3.45 percent.

The total impact of a minimum wage increase of 50% on this hypothetical business, then, is to raise its total expenses 0.69% of gross revenues, or less than one percent.

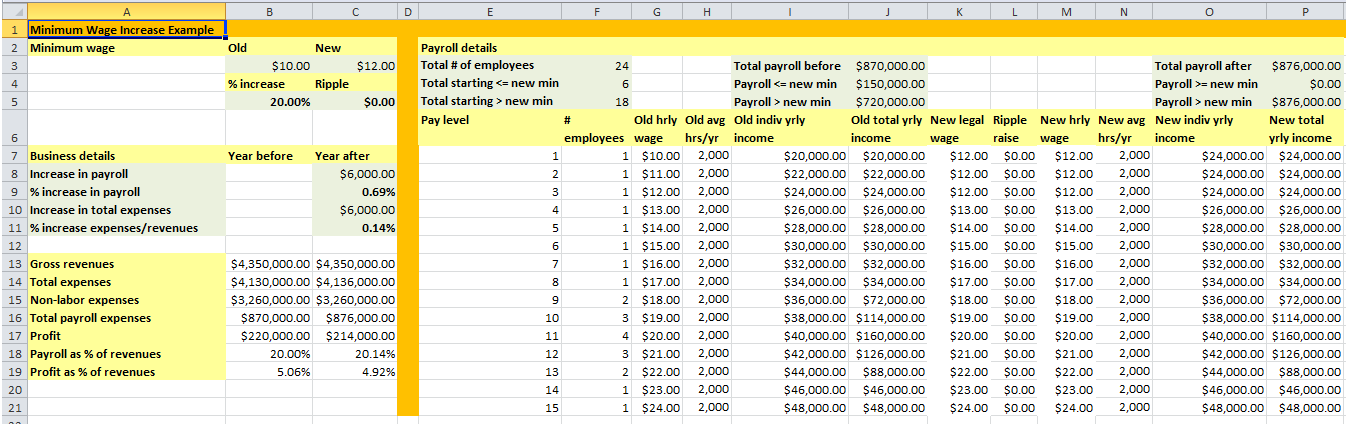

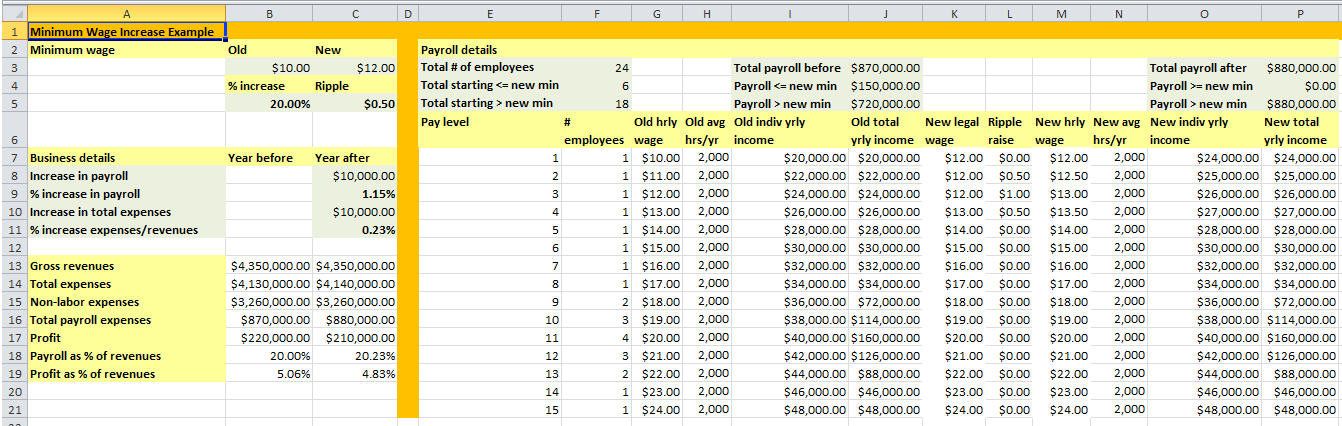

Nationally across all industries, the proportion of payroll to gross revenues is smaller, 16.8 percent[36] rather than 20 percent. And most yearly minimum wage increases have been far less than 50% – an average of 16.7% yearly for local ordinances[37] – so the percentage of affected workers would probably be closer to 10%[38] than 25%. Rounding up, for a 20.0% nominal minimum increase to $12.00 for the same sample payroll, the average for the two workers receiving raises will be 14.3%, yielding a rise in total payroll of 0.69% and in total expenses of 0.14% of gross revenues.

If we factor a ripple effect into our 50%-raise example, spillover wages that keep at least a $0.25 differential between the new levels – $15.00, $15.25, $15.50, etc. – would raise the total payroll increase from 3.23% to 4.43%, and the total increase in business expenses over revenues from 0.69 to 0.89% of gross revenues.

Applying a $0.50 ripple differential to a 20% minimum wage increase for the same data, the total payroll increase would be 1.15% and the total expenses increase would be 0.23% of revenues. We use a lower ripple for the bigger increase because ripple effects tend to be smaller for larger minimum wage increases.[39]

These examples do not take into account many factors such as taxes or benefits. But none of these would appreciably change the big picture of very small cost increases for an average business.