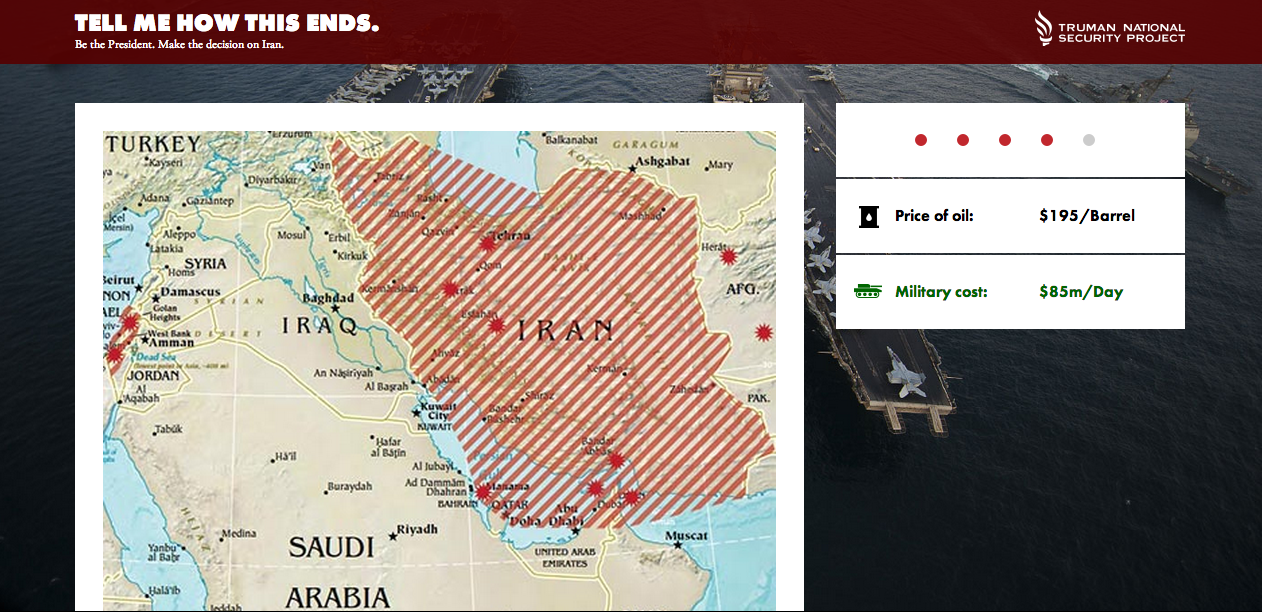

The Truman National Security Project has created an interactive version of a war game with Iran. The goal is to highlight the costs of using the military option — financially massive and downright bad for US allies and forces in the region — on the Islamic Republic.

The game [...]]]>

The Truman National Security Project has created an interactive version of a war game with Iran. The goal is to highlight the costs of using the military option — financially massive and downright bad for US allies and forces in the region — on the Islamic Republic.

The Truman National Security Project has created an interactive version of a war game with Iran. The goal is to highlight the costs of using the military option — financially massive and downright bad for US allies and forces in the region — on the Islamic Republic.

The game was developed in consultation with senior former defense department officials and military experts. Users are put in the shoes of the President who is given various modes of deployment for attacking Iran after it crosses his stated red line — acquisition of a nuclear weapon. Players are faced with quickly rising oil and military costs from the get-go, as well as retaliatory attacks against US forces and allies in the region. In sum, once the war has begun, it’s impossible to escape unscathed as harsh force will result in harsh responses from Iran and its proxies while de-escalation attempts will further endanger US interests and forces.

The game is informative and frightening, to say the least, and indicative of why the highest echelons of the Israeli and US defence establishments are hardly gung-ho about going to war with Iran, especially when striking its nuclear facilities will likely intensify Iran’s drive to go nuclear as former Secretary of Defense Robert Gates has argued, and only set back its program by 3-5 years at best

The website was launched on Friday and an accompanying television ad featuring US Army veteran Justin Ford will begin airing tonight during the national security presidential debate.

]]>

By Wayne White

An excellent October 18 article, “The Myth of ‘Surgical Strikes’ on Iran“, by David Isenberg highlighted many of the conclusions of a sobering study by industrialist Khosrow Semnani on the potentially steep human cost of even a relatively selective attack against Iran’s diverse nuclear infrastructure. Semnani maintains that if the most important facilities [...]]]>By Wayne White

An excellent October 18 article, “The Myth of ‘Surgical Strikes’ on Iran“, by David Isenberg highlighted many of the conclusions of a sobering study by industrialist Khosrow Semnani on the potentially steep human cost of even a relatively selective attack against Iran’s diverse nuclear infrastructure. Semnani maintains that if the most important facilities are hit during work shifts, on site casualties could be as high as 10,000. Additionally, since a few of the most important Iranian nuclear installations are located near population centers, toxic nuclear materials unleashed by the attacks could possibly inflict an even higher number of casualties on civilians. Yet, Semnani focused most of his attention on the the casualties stemming from attacks focused on just one critical slice of the nuclear sector, with less detailed references to other targets (which he notes could involve a grand total of “400″) that might be struck in an especially robust air campaign against Iran. Indeed, if the US in particular decided to carry out such attacks, some detail on the potential — in fact likely — impact far beyond Iran’s most high-profile nuclear facilities and their immediate surroundings needs to be added to this picture to gain a full appreciation of the extent of potential Iranian casualties.

An excellent October 18 article, “The Myth of ‘Surgical Strikes’ on Iran“, by David Isenberg highlighted many of the conclusions of a sobering study by industrialist Khosrow Semnani on the potentially steep human cost of even a relatively selective attack against Iran’s diverse nuclear infrastructure. Semnani maintains that if the most important facilities are hit during work shifts, on site casualties could be as high as 10,000. Additionally, since a few of the most important Iranian nuclear installations are located near population centers, toxic nuclear materials unleashed by the attacks could possibly inflict an even higher number of casualties on civilians. Yet, Semnani focused most of his attention on the the casualties stemming from attacks focused on just one critical slice of the nuclear sector, with less detailed references to other targets (which he notes could involve a grand total of “400″) that might be struck in an especially robust air campaign against Iran. Indeed, if the US in particular decided to carry out such attacks, some detail on the potential — in fact likely — impact far beyond Iran’s most high-profile nuclear facilities and their immediate surroundings needs to be added to this picture to gain a full appreciation of the extent of potential Iranian casualties.Yet, as opposed to the relatively limited scope of any Israeli attack dictated by the extreme range involved and the smaller aerial strike package that could be deployed (in terms of extending casualties beyond those outlined in the article and Semnani’s study, both nuclear and civilian), many expect that any US attack on Iran’s nuclear capabilities would be far more comprehensive. Specifically, the US would be able to muster a much larger force of aircraft (and cruise missiles) with which to operate, and at far closer range. In order to clear paths to the targets cited, I am among those observers who anticipate in such a scenario waves of parallel US strikes against Iranian military communications, land-based anti-ship missile sites, any Iranian naval forces that could pose a potential threat to US warships operating offshore (as well as the Strait of Hormuz more generally), Iranian air force aircraft and bases, as well as Iranian anti-aircraft defenses. Finally, there might also be an attempt to take out as much of Iran’s ballistic missile testing, manufacturing, storage, and basing assets as possible. After all, Iran’s ambitious missile program relates directly to Iran’s ability to retaliate and might be associated with any eventual Iranian intent to weaponize and deliver nuclear weapons.

In other words, not only could a US assault (much as outlined in 2006 by the US military in its briefings of the Bush Administration, including potentially several thousand missions by combat aircraft) extend far beyond anything any reasonable individual could possibly regard as ”surgical,” the overall attack probably would more closely resemble a flat-out war. And, naturally, in the context of such a considerably more dire scenario, those attempting to estimate potential casualties (nuclear industry workers, civilians, as well as Iranian military personnel) would be advised to hike them up quite a bit higher.

- Wayne White is a Policy Expert with Washington’s Middle East Policy Council. He was formerly the Deputy Director of the State Department’s Bureau of Intelligence and Research’s Office of Analysis for the Near East and South Asia (INR/NESA) and senior regional analyst. Find his author archive here.

About 32 percent of all stock trades in the US stock markets are being done “off market” in “dark pools” and other confidential “trading platforms”. Trading on well-known markets such as the New York Stock Exchange and NASDAQ has been dropping precipitously.

The “dark pools” have taken over some increasing [...]]]>

About 32 percent of all stock trades in the US stock markets are being done “off market” in “dark pools” and other confidential “trading platforms”. Trading on well-known markets such as the New York Stock Exchange and NASDAQ has been dropping precipitously.

About 32 percent of all stock trades in the US stock markets are being done “off market” in “dark pools” and other confidential “trading platforms”. Trading on well-known markets such as the New York Stock Exchange and NASDAQ has been dropping precipitously.

The “dark pools” have taken over some increasing chunks of the market shares that used to go to these and other major exchanges. Also, as the article from Business Week points out, massive amounts of money have fled the normal stock and other equity markets due to a lack of confidence and trust in those markets.

This video from the Wall Street Jounal explains what “dark pools” are. Most people are likely very much in the dark about them.

To put it simply, “dark pools” are pools of liquidity and financial capital that are flowing from one trader to another. One customer of a broker might need to move a large amount of a certain security, stock, derivative, bond or bill without it being noticed on the public markets. ”Dark pools” are confidential, secret and certainly not registered with the SEC or on any public notice boards of the trades.

If the large trade were to flow into the data banks of the algorithms of the high frequency traders — who really run the market to a very big extent — then the price of the security the trader wants to move can drop rather quickly. So, it is thought by these surreptitious security traders that one can retain more value by keeping the trades secret. “Dark pools” have been developing in China, the EU, and even in places like Indonesia, the Philippines, and all across the world.

Increasing development of the dozens of confidential platforms is in part a response to the development of high speed trading. High speed trading has a huge influence on the stock markets in the US and in many other countries. As the risks to trading have increased with the faster diffusion into the marketplace of high speed trading, so too have the “dark pools” and other surreptitious trading platforms developed.

There have been many instances of obvious mispricing of securities by some of these black box algorithms, such as sending the price of many well capitalized companies heading towards penny stocks in the matter of seconds during “flash crashes”, as happened in May 2010. One of the biggest energy companies in the world, Exelon, was deemed almost worthless on the markets for a moment. Proctor and Gamble became a penny stock.

One of the main reasons behind this flash crash was the high frequency trading companies’ algorithms (hyper complex mathematical stock and derivative trading models) kicking in to react to an order to sell 75,000 E-Mini Standard & Poor’s 500 futures contracts. If this seems somewhat to very obscure to you do not get worried that you are out of the loop on what is really going on in the stock, futures and derivatives markets. My guess is 99 percent of the people in the US, if not the world, are pretty much clueless about what is happening and who is doing what.

It is not just the existence of “dark pools” or of high speed trading that lends to huge potential volatility — even worse is the combination of the two. There is an increasing opacity to securities markets while at the same time an increasing dominance of very complex, black box mathematical algorithms that trade at velocities that are beyond the comprehension of just about everyone, including some of the people who are at the top of these trading companies.

One of my biggest concerns about high frequency trading is that the models, the algorithms used for trades, may not be built to handle major commodity price shocks, such as what may occur with an invasion of Iran and the response and counter-response that may happen after that.

One only has to consider the 1998 collapse of Long Term Capital Management (LTCM) that was sparked by the combination of the East Asian Financial Crises in 1997-1998, the default of Russia and the collapse of the ruble, as well as other complex factors, to see how this may happen again.

Please note LTCM was established by a bunch of Nobel Laureates and had some of the best and brightest “rocket scientists” of algorithm development on their staff. This article from CATO also discusses the government sponsored and constructed bailout of LTCM. Sound familiar? This was in 1998.

I find the potential robustness of these models in times of even moderate stress to be suspect.

We can now add in the problems that could result from the “dark pools” to the “high frequency trading” to those of the shadow banks that I mentioned in a previous article.

Indeed, the risks to the toppling of asset values and economies via oil and other commodity shocks are looming if there are any serious military shocks, most particularly if significant oil facilities such as Ab Qaiq are seriously damaged in the medium to long runs.

It is not just an attack of Iran that would shock the markets, but what follows after that. Iran is unlikely to back down and cower. It will counter attack. The Iranians have stated this quite clearly.

The effects of these shocks could also be magnified due to the fragility of the global economy. That volatility can be further magnified by the fall of the assets that back the shadow banking systems of securities and derivatives. This could be made even worse via high frequency trading and the increasing opacity of markets via “dark pools”.

One might expect large investors to initially flock to the “dark pools” to dump their securities. This may be kept quiet for a short while. However, sooner rather than later, the expected huge movements of assets that will be attempted to be dumped to preserve value will be noticed and talked about. Then the high frequency trades kick in full force. Add to this the fall in assets backing up the hundreds of trillions of dollars in derivatives and you have quite a problem.

Can you imagine the “flash crash” developing into a “smash crash” from a spreading conflict in the Gulf?

I really wonder how those black box computer programs would respond when the price of oil goes beyond the outer boundaries of their assumptions – and stays there.

Many markets have become too fast, too incomprehensible, and too opaque for the average investor and even for most governments. Some of these markets may be heading toward a dangerous tipping point on some issues not far in the future anyway.

A war in an area with 70 percent of all known commercially available conventional oil reserves and all of the excess oil capacity in the world may help that tipping point to arrive faster and in a more furious way.

Very few know what is really happening in the “dark pools”. Very few know what is really happening inside those black box algorithms of the high frequency traders. Shadow banking remains in the shadows.

Policy recommendation: governments and others need to look more into these dark regions to fully analyze certain strategic economic, political and other decisions. The world economy has changed vastly even in the last few years with massive liquidity traps and small reactions to monetary and fiscal policy than in the past and the existence of many great unknowns that contain massive amounts of assets within them. These policy responses need to be global as well as national given the massive international flows of money each day, often in the trillions of dollars if one also adds in foreign exchange transactions.

This odd amalgam of the old and new financial systems may be resilient to normal shocks and small shocks, but big shocks could make things rather bad indeed.

Governments and others need to understand and navigate in the dark corners of finance — and there are many of them — in order to understand what might happen next.

]]>Shadow banks may control about 25 to 30 percent of the word’s financial system. They may be about 50 percent of all banking assets in the world. I say may in both of those sentences because it is hard to tell how big this financial sector is. The United States may [...]]]>

Shadow banks may control about 25 to 30 percent of the word’s financial system. They may be about 50 percent of all banking assets in the world. I say may in both of those sentences because it is hard to tell how big this financial sector is. The United States may make up about 40 to 50 percent of all shadow banking. However, shadow banking is spread throughout the world.

Shadow banks may control about 25 to 30 percent of the word’s financial system. They may be about 50 percent of all banking assets in the world. I say may in both of those sentences because it is hard to tell how big this financial sector is. The United States may make up about 40 to 50 percent of all shadow banking. However, shadow banking is spread throughout the world.

Shadow banks are not as regulated as regular banks. They also go about gathering capital for lending in a different way than regular banks. They often securitize assets such as commercial and residential mortgages, corporate bonds, consumer loan packages, and the like. Shadow banks also find other assets and derivatives of those assets to back up their securitized debt instruments. Many use US Treasury bills and other sovereign debt (the debt instruments of many nations and their equivalent of Treasury bills, for example) to act as risk mitigation and collateral in the “loan” making process.

Shadow banks also rely on something called the repurchase (repo) markets to liquefy debt and other assets in the short run – even though most of these assets are long run ones, like mortgages and long term bonds. Simply put, repos are a way to quickly pay off short term debts and also to get some of the debt off the books of the shadow banks either overnight or even for longer periods.

Ok, this is all very complicated. Frankly, for the shadow banks that complexity has protected them over the years. It has also led to some very big crashes because the people who should have understood what was going on did not. That includes many governments and even some of the leadership of the shadow banks themselves.

So what we have is a large massive part of the world financial system basing its capital on sliced and diced assets with sometimes questionable risk calculations and even sometimes questionable valuations of the assets. How much might it be? How does $40 trillion dollars sound?

The valuation of the assets could be a real problem if there is a war with Iran that gets out of hand and leads to significant damage to oil and gas fields and facilities in the Gulf. If energy prices spike and spike again for the short run, the market could bear that. If the oil and gas prices spike and stay way up in many markets then we have a much bigger problem.

One of the mechanisms of asset destruction in the shadow banking system can be a huge increase in energy prices followed by recessions or worse in many places, including in the already fragile EU, China and the US. Other commodity and goods prices will be affected as well.

Many shadow bank assets are heavily leveraged. Does this sound familiar? Leveraged shadow bank assets took down the US and part of the world economy when the housing market went bust in 2007-2008.

Many shadow banks are heavily into derivatives and even derivatives of derivatives. If the underlying assets of the derivatives collapse due to falling economies then the derivatives collapse along with them.

It is quite possible that under some war and conflict scenarios attached to scenarios of oil and gas prices that the economic impacts of a protracted and quite damaging war with Iran could be magnified well beyond the normal way this is considered.

Shadow banking is huge. It needs to be considered in calculations about military conflict. The losses could be gigantic on the financial markets.

Some shadow banks might benefit from war if some of the sharpies in the shadow banks have already set up derivatives and options as hedges betting on a war. They cash in if the war happens.

Either way some people in the shadow banks could lose. Some could win.

The regular folks lose. The top guns in the shadow banks will drive their Ferraris. The regular people may end up selling apples.

You see, a war with Iran now would be very different than if it happened in 1979. Back then the shadow banking system was tiny. Derivative markets were tiny compared to what they are now. The leverage and risk inherent in sometimes unstable sliced and diced assets in the tens of trillions was just not there.

Is this something to think about? I surely believe so. I am going to look much more deeply into this situation and hope to have more to write about it to clarify and educate, hopefully before possibly catastrophic events take place.

Policy conclusion: take great care and do your homework on the realities of the risks within the world economy before stepping off the cliff toward a potentially very costly war.

To read more about shadow banking try:

- - Casting more light on shadow banking

- The run on shadow banking and a framework for reform

- The Shadow Banking System – Survey and Typological Framework

Israelis are being sold on war with Iran in more ways than one.

In a commercial featuring John Cleese (a veteran of the zany British comedy shows, Monty Python’s Flying Circus and Fawlty Towers) a high level general takes a taste of a delectable chocolate and hazelnut spread and inadvertently [...]]]>

Israelis are being sold on war with Iran in more ways than one.

Israelis are being sold on war with Iran in more ways than one.

In a commercial featuring John Cleese (a veteran of the zany British comedy shows, Monty Python’s Flying Circus and Fawlty Towers) a high level general takes a taste of a delectable chocolate and hazelnut spread and inadvertently sets in motion an Israeli military strike on an unnamed country — Iran by implication and context — a command that the Israelis have been waiting for and are eager to carry out.

The ad’s tour de force hinges on a pun. Three high level military officers, for whom “General Rogers” (Cleese) is the spokesman, are seated at a table in a war room. Across the table is a silver-haired man flanked by two military officers trying to persuade the generals to authorize an attack that they are apparently reluctant to approve. “I promise you we will be in and out in 33 minutes,” the silver-haired civilian tells them. “We have the right to defend ourselves!” Mulling what the panel’s response ought to be, Cleese opens the container of chocolate-hazelnut spread that happens to be on the tablet, removes the inner liner and licks it. Impressed, he reads the product’s name aloud: Sababa Egozim. Adweek claims the phrase translates into something like “Let’s get nuts.” According to Gabe Fisher in the Times of Israel:

“Sababa” means “cool” in Israeli slang (taken from the Arabic, like many Hebrew slang words) and “egozim” are “nuts.” Put together, though, the term is slang for “super cool” or “hell yeah.”

Whatever the translation, the Israelis construe Cleese’s utterance as the generals’ official approval of a military strike. Delighted, they give one another victorious high five signs and triumphantly exit to launch their attack.

Tim Nudd of Adweek has criticized the promotional video for being “weird” and has faulted the offbeat comic for doing anything for money. An earlier version of the Adweek article, quoted by the British website, The Drum, apparently included the observation, “What would the young, rebellious Cleese, at the height of his powers in the early 1970s, say if he could see the depths to which his septuagenarian self has sunk?” Cleese reportedly received $50,00o for appearing in the ad, which was filmed in Monaco, where he lives.

This isn’t the first case of an Israeli commercial finding humor in Israel’s bellicose relationship with Iran. Last February — a few weeks after the assassination of an Iranian nuclear scientist, Mostafa Ahmadi Roshan, that was widely believed to have been carried out by the Mossad — a commercial for the Israeli cable company HOT featured four characters from the Israeli television series Asfur. Poorly disguised as Iranian women, the foursome wonder how they’ll be able to find Kosher food in Iran. They meet a Mossad agent who is watching their show on his Samsung tablet. While examining the numerous features of the tablet, which the cable company was offering for free in a promotion, one of the “women” accidentally touches a button that causes a nearby nuclear plant to explode. The timing of the commercial also coincided with an upsurge in media speculation that Israel was indeed on the verge of attacking Iran this past spring.

Iranians didn’t think the ad was very funny. Iran’s Press TV objected to the ad’s assumption that Israel was powerful enough to easily destroy Iran’s nuclear facilities, and its lighthearted view of the assassination of the country’s nuclear scientists. Arsalan Fathipour, an Iranian lawmaker who heads the Energy Committee of Iran’s parliament, called for a ban on the import of all Samsung products, objecting to Samsung’s attempt to curry favor with Israelis through the commercial. A Samsung spokesperson in Iran insisted that HOT — not Samsung — had produced the ad and was not responsible for its contents, while Samsung’s Dubai office condemned the role of the company’s Israel office in the production.

What do these Israeli commercials that make light of Israeli attacks and sabotage against Iran reveal about the prospects for war? Joking about attacking Iran may function as an emotional safety valve for Israelis, allowing them to cope with a geopolitical situation that may be spinning out of control. Iranians can hardly be blamed if they don’t appreciate the humor. An optimist might opine that Israelis being able to find amusement in attacking Iran could indicate that an actual strike is less likely.

But humor about an attack on Iran may also signal a darker trend in Israeli popular culture: the acceptance that war with Iran is inevitable, so Israelis might as well take it in stride, sit back and enjoy the show.

]]>In recent months, we have had some strong views expressed, by people who have real knowledge of the situation, about the potential consequences of a military strike by Israel and/or the United States against Iran’s nuclear infrastructure. Former Mossad head Meir Dagan says it is “The stupidest idea I’ve ever heard.”

[...]]]> In recent months, we have had some strong views expressed, by people who have real knowledge of the situation, about the potential consequences of a military strike by Israel and/or the United States against Iran’s nuclear infrastructure. Former Mossad head Meir Dagan says it is “The stupidest idea I’ve ever heard.”

In recent months, we have had some strong views expressed, by people who have real knowledge of the situation, about the potential consequences of a military strike by Israel and/or the United States against Iran’s nuclear infrastructure. Former Mossad head Meir Dagan says it is “The stupidest idea I’ve ever heard.”

On Friday, Secretary of Defense Leon Panetta, speaking to a strongly pro-Israel audience at the Saban Center in Washington, responded as follows to a question about how long a military attack on Iran would postpone it from getting a bomb:

SEC. PANETTA: Part of the problem here is the concern that at best, I think – talking to my friends – the indication is that at best it might postpone it maybe one, possibly two years. It depends on the ability to truly get the targets that they’re after. Frankly, some of those targets are very difficult to get at.

That kind of, that kind of shot would only, I think, ultimately not destroy their ability to produce an atomic weapon, but simply delay it – number one. Of greater concern to me are the unintended consequences, which would be that ultimately it would have a backlash and the regime that is weak now, a regime that is isolated would suddenly be able to reestablish itself, suddenly be able to get support in the region, and suddenly instead of being isolated would get the greater support in a region that right now views it as a pariah.

Thirdly, the United States would obviously be blamed and we could possibly be the target of retaliation from Iran, striking our ships, striking our military bases. Fourthly – there are economic consequences to that attack – severe economic consequences that could impact a very fragile economy in Europe and a fragile economy here in the United States. And lastly I think that the consequence could be that we would have an escalation that would take place that would not only involve many lives, but I think could consume the Middle East in a confrontation and a conflict that we would regret.

So we have to be careful about the unintended consequences of that kind of an attack.